Trust vs Company: Which Structure Is Right for Your Business?

Trust vs Company: Which Structure Is Right for Your Business? Robert January 14, 2026 Insights Trust vs Company: Which Structure Is Right for Your Business? One of the most common questions business owners ask is whether they should operate through a trust or a company. There is no one-size-fits-all answer. The right structure depends on […]

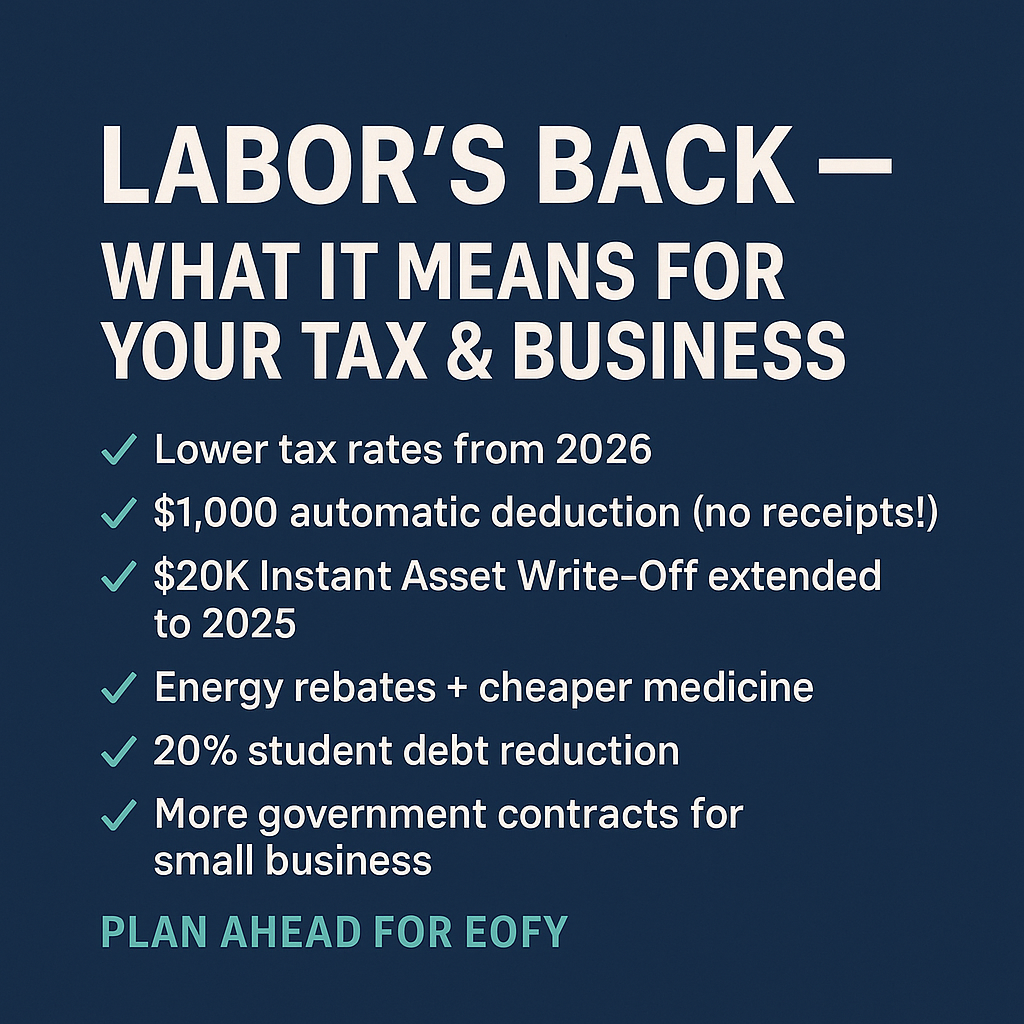

What Labor’s 2025 Election Win Means for Your Taxes and Small Business

What Labor’s 2025 Election Win Means for Your Taxes and Small Business Robert May 4, 2025 Insights Labor’s Election Victory: What It Means for Australian Taxpayers and Small Businesses In a decisive result, the Australian Labor Party, led by Prime Minister Anthony Albanese, has secured a second term following the 2025 federal election. With a […]

Smart Tax Planning Strategies for the 2025 Financial Year

Smart Tax Planning Strategies for the 2025 Financial Year Robert February 24, 2025 Insights Smart Tax Planning Strategies for the 2025 Financial Year The start of a new financial year isn’t just about meeting tax obligations—it’s an opportunity to take control of your finances and plan ahead. Whether you’re a business owner or an individual […]

Key Tax Changes for the 2025 Financial Year: What You Need to Know

Key Tax Changes for the 2025 Financial Year: What You Need to Know Robert February 24, 2025 Insights Key Tax Changes for the 2025 Financial Year: What You Need to Know As we approach the 2025 financial year, several important tax updates are set to take effect from 1 July 2024. These changes will impact […]

ATO Loses Key Division 7A Case – What It Means for You

ATO Loses Key Division 7A Case – What It Means for You Robert February 24, 2025 Insights On 19 February 2025, the Full Federal Court delivered a landmark decision in Commissioner of Taxation v Bendel [2025] FCAFC 15, significantly impacting how unpaid present entitlements (UPEs) from trusts to corporate beneficiaries are treated under Division 7A. If […]